Renters Insurance in and around Chicago Heights

Chicago Heights renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Chicago

- Flossmoor

- Glenwood

- Olympia Fields

- Park Forest

- Homewood

- Matteson

- Country Club Hills

- Hazel Crest

- Lansing

- Lynwood

- Sauk Village

- South Holland

- Dolton

- Harvey

- Calumet City

Home Is Where Your Heart Is

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your desk to your guitar. Not sure how much insurance you need? That's alright! Karen Graham is here to help you identify coverage needs and help select the right policy today.

Chicago Heights renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renting is the smart choice for lots of people in Chicago Heights. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover repairs for tornado damage to the roof or an abrupt leak that causes water damage, what about the things you own? Finding the right coverage helps your Chicago Heights rental be a sweet place to be. State Farm has coverage options to align with your specific needs. Thank goodness that you won’t have to figure that out on your own. With empathy and reliable customer service, Agent Karen Graham can walk you through every step to help you develop a policy that guards the rental you call home and everything you’ve invested in.

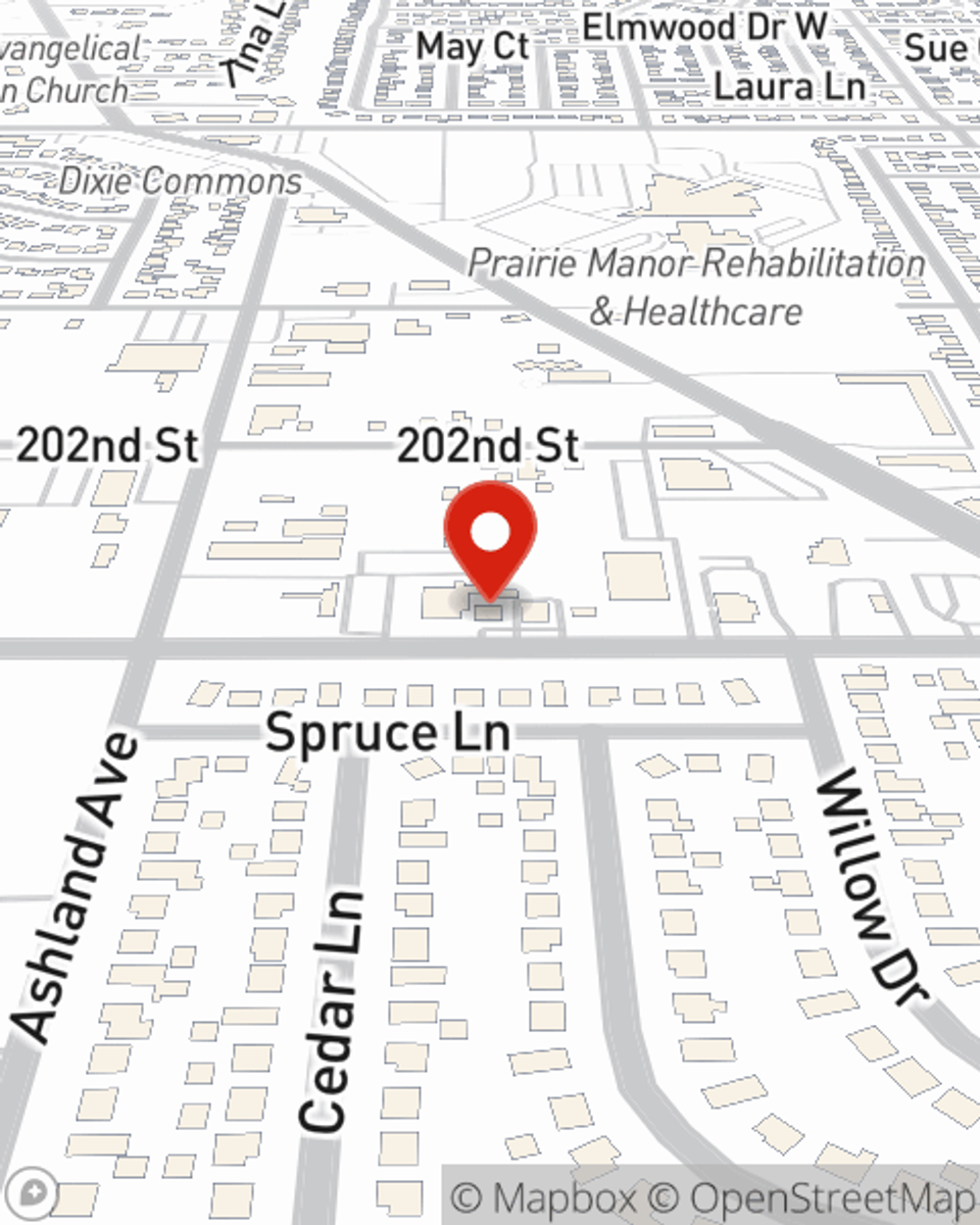

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Chicago Heights. Get in touch with agent Karen Graham's office to see about a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Karen at (708) 755-3000 or visit our FAQ page.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Karen Graham

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.